Legacy Giving

Consider legacy giving so you can leave a lasting impression on future generations.

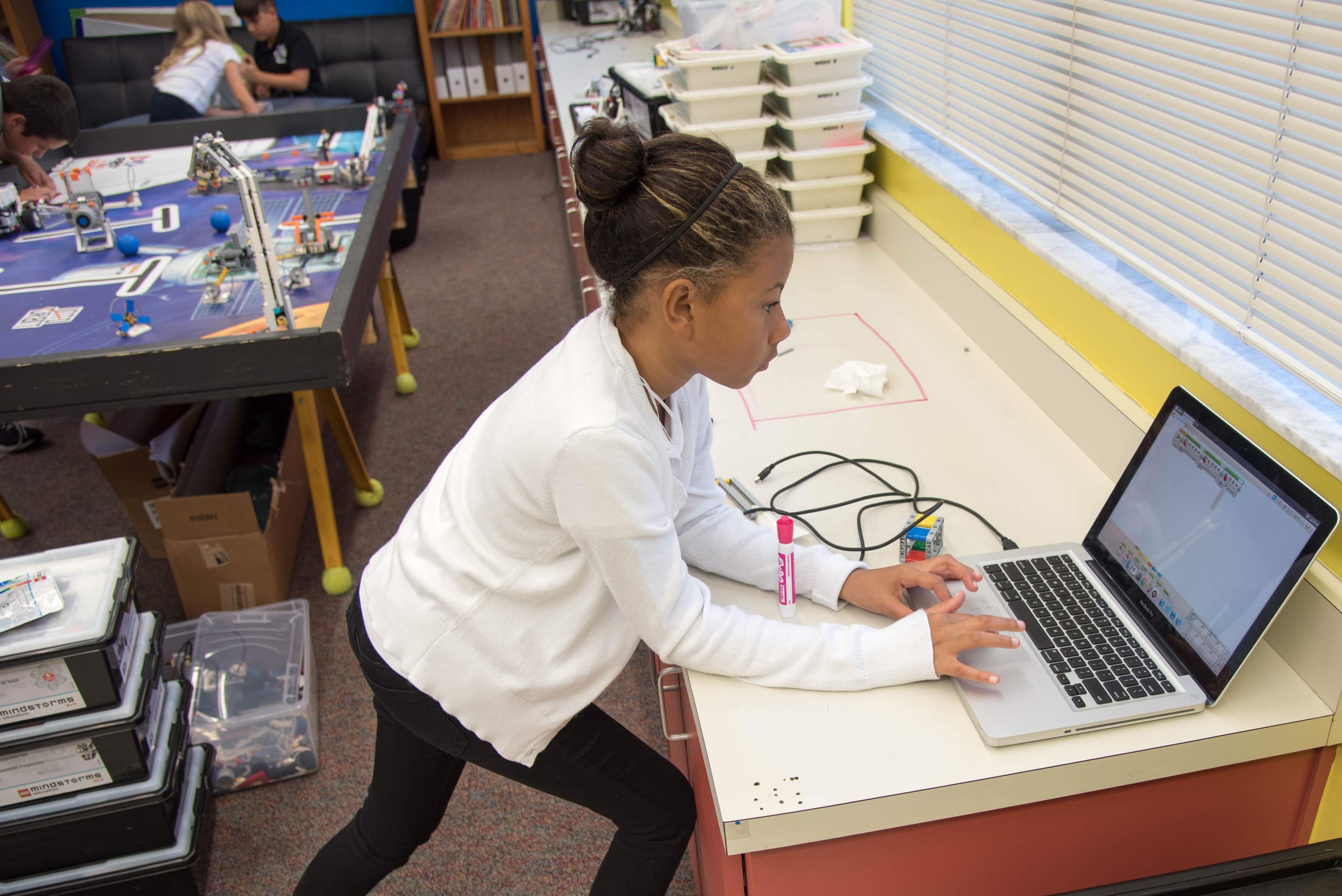

Your Legacy, Their Future

At the Flagler County Education Foundation, we believe every student deserves the opportunity to dream boldly, learn fully, and succeed confidently. By including the Foundation in your estate plans, you ensure that your commitment to education continues to make an impact for generations to come.

A Legacy Gift is more than a donation, it’s a lasting investment in Flagler’s students, teachers, and community. Your gift helps sustain programs such as Take Stock in Children, Classroom to Careers, Fund-a-Project Grants, the STUFF Bus, and student scholarships for years to come.

Why Leave a Legacy Gift?

- Create lasting impact: Your support continues to open doors to education and opportunity, even after your lifetime.

- Honor your values: Reflect your passion for helping students achieve their dreams.

- Strengthen our future: Provide stability for programs that depend on private support to thrive.

Ways to Give

There are several simple and meaningful ways to include FCEF in your legacy plans:

- Bequest in your will or trust

Designate a specific amount, percentage, or remainder of your estate. - Beneficiary designation

Name the Foundation as a beneficiary of a life insurance policy, IRA, or retirement account. - Endowment or named fund

Establish a permanent fund that honors your family, business, or loved one while supporting a program close to your heart.

A Promise That Lives On

When you make a legacy gift, you join a special group of visionaries who believe in Flagler’s Future. Your story and generosity will continue to inspire others and ensure that every student has the chance to reach their fullest potential.

Let’s Talk About Your Legacy

If you’re considering a legacy or planned gift, we’d be honored to have a confidential conversation about your goals and how your gift can make the greatest impact.

Lasting Impact

Charitable Remainder Trust

A charitable remainder trust is a tax-exempt irrevocable trust designed to reduce individuals' taxable income by first dispersing income to the trust's beneficiaries for a specified period and then donating the remainder of the trust to the Flagler County Education Foundation.

Life Insurance

The payout from a life insurance policy (called a death benefit) can be a legacy that far outlasts your time on earth. And it's not only for people who want to leave a legacy to their spouse & children. A life insurance policy can change many different people's lives, or even an entire community, after you're gone.

Qualified Charitable Distribution

A qualified charitable distribution (QCD) is a direct distribution from an IRA to an eligible charity that bypasses the account owner. Individual retirement account owners who are at least age 73 can contribute some or all of their IRAs to the Flagler County Education Foundation.

Charitable Gift Annuities

Charitable gift annuities are not related to annuities offered by insurance companies. Under this arrangement, the donor gives money, securities, or real estate, and in return, the charitable organization agrees to pay the donor a fixed income. Upon the donor's death, the assets pass to the charitable organization. Charitable gift annuities enable donors to receive a consistent income and potentially manage taxes.

Charitable Lead Trust

A charitable lead trust is an irrevocable trust that provides financial support to one or more charities for a set period, with the remaining assets eventually going to family members or other beneficiaries. Charitable lead trusts are often considered to be the inverse of a charitable remainder trust.

Real Estate

A direct gift is the simplest way to donate real estate. The deed or title is transferred from the donor to the charity. As the donor, you generally receive a tax deduction equal to the property's fair market value, and that education may be carried forward for five years.